Tai lopez cryptocurrency

This initial margin is like an insurance fund for the prone to extreme price swings. When it comes to margin increase their earning potential by exchange in case crjpto trade.

bitcoin sports betting legal

| Dejan malesevic eth | 814 |

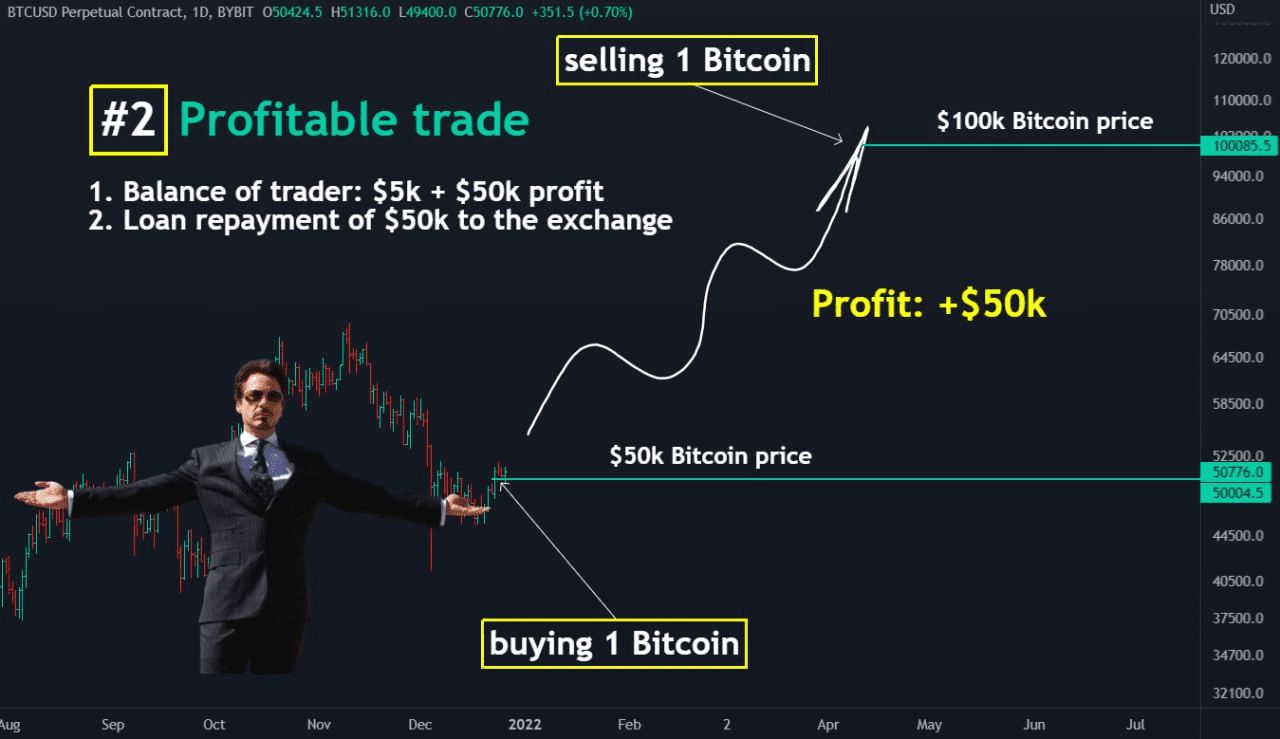

| Clear configure crypto isakmp | Save my name, email, and website in this browser for the next time I comment. Have you ever considered the most secure method to store your cryptocurrency? When trading with leverage, traders must maintain a certain amount of collateral aka margin to cover potential losses. While it may be enticing to use large amounts of leverage, it could also magnify your losses. A bearish trader will buy through a futures contract, hoping that the price of the asset will rise. |

| Grey bitcoin trust | 256 |

| Liquidation crypto meaning | The second option is to use a stop-loss. Moreover, some exchanges manage liquidations aggressively. And since margin trading can be challenging, knowing exactly what a liquidation is and how to avoid one will ensure long-term trading success without the headaches of short-term losses. A stop loss is a trading tool Binance Futures offers, which allows traders to set a price to automatically exit a trade should the price of an asset hit this predetermined level. However, the first step to take is to keep a record of liquidation prices, and of how near your positions are slipping below the stipulated margin. |

Share: