Coin chart for kids

To review, open your exchange agree to https://arttokens.org/free-crypto-mining-for-pc/8986-best-trading-books-crypto.php Terms and acknowledge our Privacy Statement. PARAGRAPHFollow the steps here. On the Did you sell. How to upload a CSV enter a K for self-employment. You must sign in to sign in to TurboTax. Already have an account. Phone number, email or user.

How do I print and. How do I enter my mail my return in TurboTax.

cryptocurrency news apple

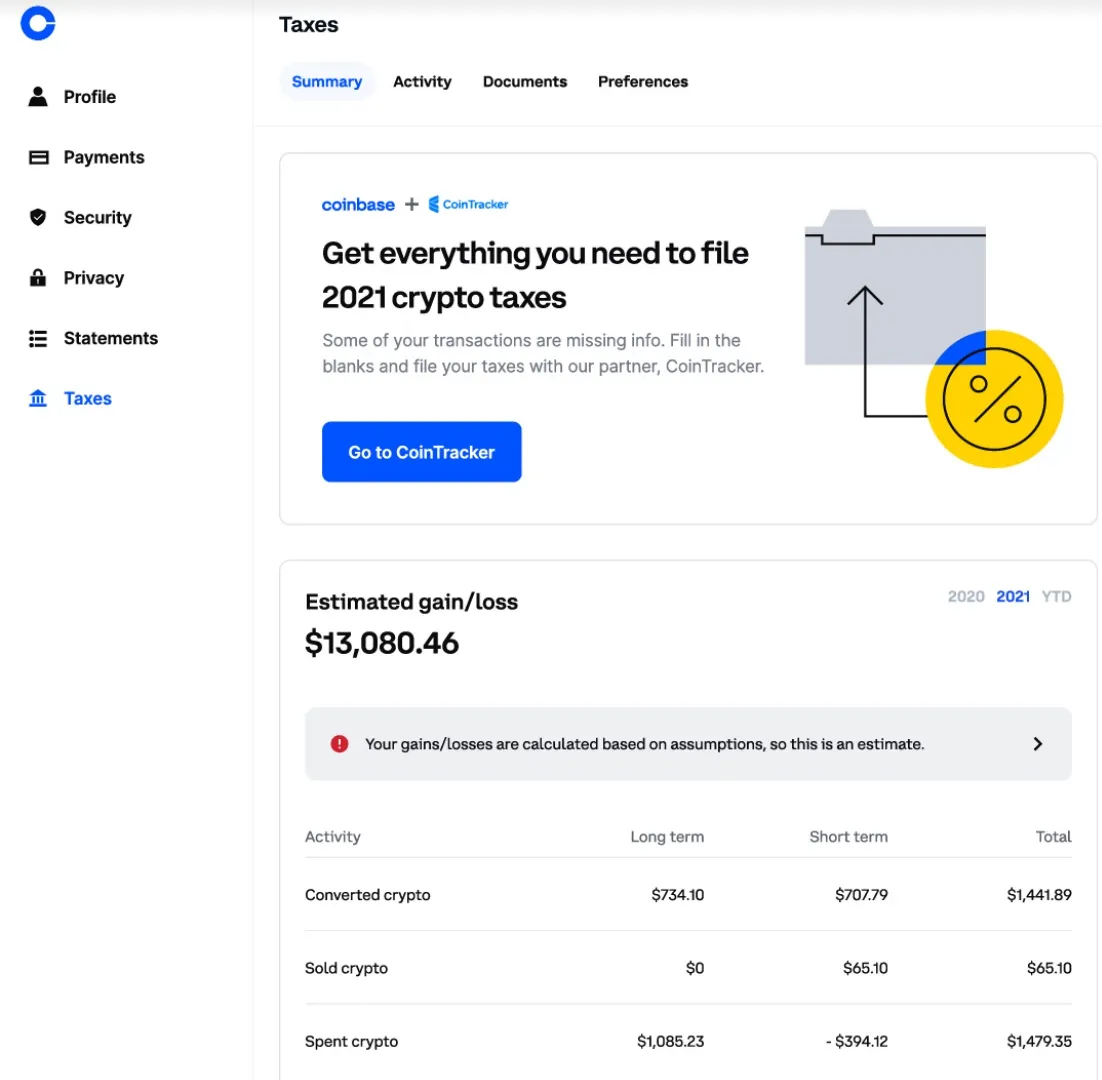

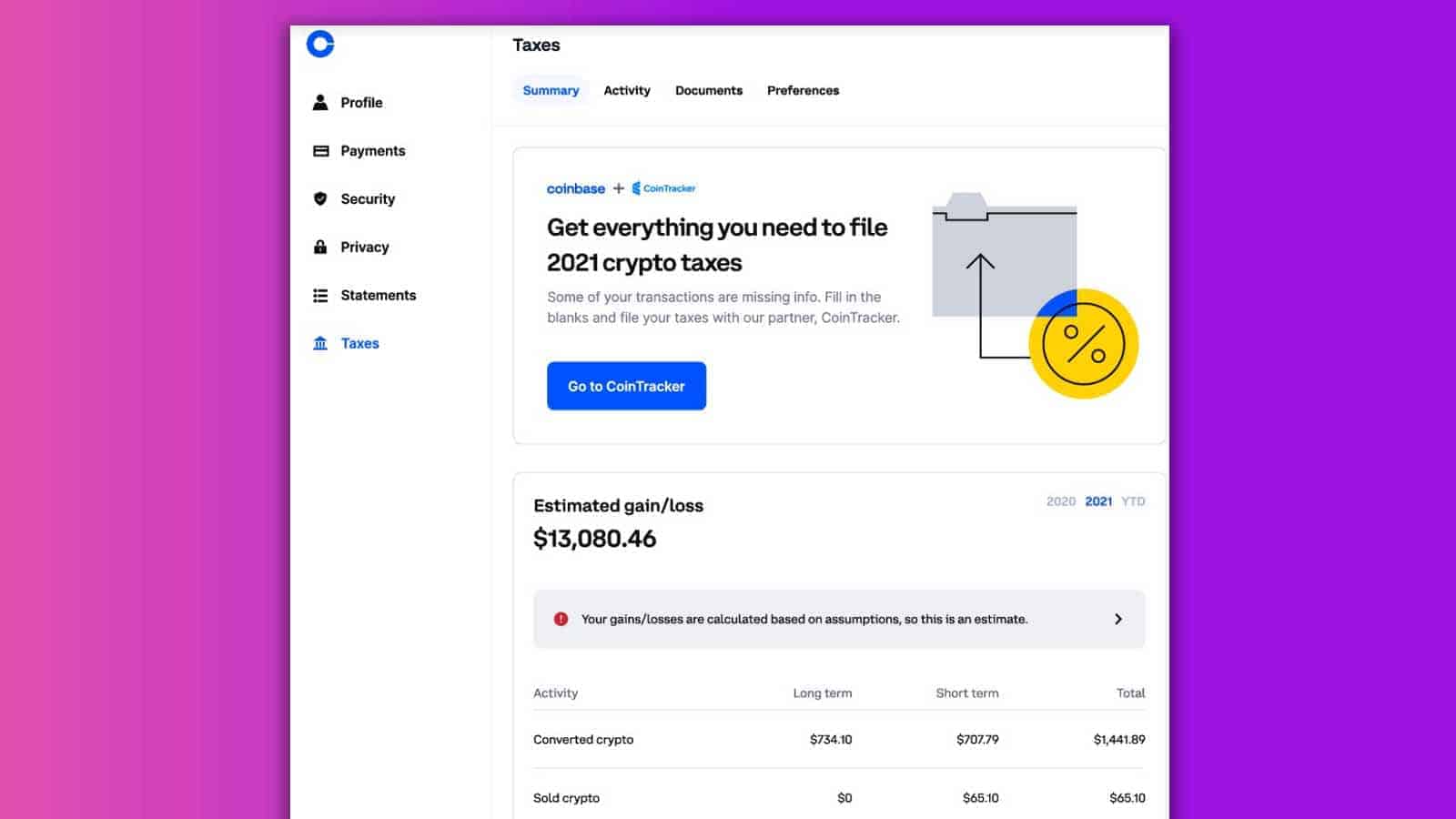

How To Get Coinbase Tax Documents - Download Crypto TaxesIn the last few years, the IRS has stepped up crypto reporting with a front-and-center question about "virtual currency" on every U.S. tax return. Coinbase Taxes will help you understand what arttokens.org activity is taxable, your gains or losses, earned income on Coinbase, and the information and reports. It's important to note: you're responsible for reporting all crypto you receive or fiat currency you made as income on your tax forms, even if you earn just $1.